If you live in Cameroon and work in the private sector, chances are you're already contributing to CNPS without knowing how to benefit from it. CNPS Health Insurance is a government-run social insurance system that helps cover part of your medical expenses. Yet, many workers don’t understand how it works or how to access the benefits when they fall sick.

Whether you're employed, self-employed, or retired, this health insurance can help reduce your out-of-pocket hospital bills. However, using it correctly can be confusing if no one has ever explained the process to you.

If you're wondering how to use CNPS Health Insurance in Cameroon, this article is here to guide you step-by-step so you can make the most of your coverage.

What is CNPS Health Insurance?

CNPS stands for Caisse Nationale de Prévoyance Sociale, which translates to the National Social Insurance Fund in Cameroon in English. It's a public institution that manages social security for workers, especially those in the private sector. One of its services is CNPS Health Insurance, which helps contributors get access to medical care at reduced costs.

The idea is simple: every month, your employer or you (if self-employed) pay contributions to CNPS. In return, you are entitled to certain health benefits such as subsidized consultations, hospital treatments, surgeries, and maternity services.

This insurance doesn’t cover 100% of your bills, but it greatly reduces them, depending on the treatment and the hospital you use. Only approved medical centers can accept CNPS coverage, so it’s important to know where and how to use it.

If you're employed in a private company, a civil servant not covered under public health insurance, or even self-employed and registered, you're likely eligible for CNPS Health Insurance.

Who Can Benefit from CNPS Health Insurance?

To benefit from CNPS Health Insurance, you must be an active or registered contributor. This includes:

- Employees in private companies whose employers declare and pay monthly CNPS contributions.

- Self-employed persons who have voluntarily registered and contribute.

- Retired workers who are still eligible under CNPS coverage.

- In some cases, spouses and children of registered workers may also benefit.

If you're a private company employee and CNPS is deducted from your salary, you’re already contributing—even if you’ve never used the service before. It’s your right to benefit from it, and knowing how to access this coverage can save you a lot of money in medical expenses.

What Does CNPS Health Insurance Cover?

CNPS Health Insurance helps you reduce the cost of several basic healthcare services. It doesn’t cover everything, but it takes care of a significant portion of common medical expenses. This support can be a big relief, especially during emergencies or maternity care.

Services typically covered include:

- General medical consultations

- Laboratory tests (only basic and approved ones)

- Hospital stays (for approved conditions)

- Minor and some major surgeries

- Prescription medications (only listed ones)

- Maternity services (antenatal, delivery, postnatal)

It's important to note that CNPS only covers part of the bill, usually between 50% and 80%, depending on the procedure and the hospital. You are responsible for paying the rest.

Services not usually covered include:

- Cosmetic or plastic surgery

- Luxury hospital rooms or VIP care

- Some private hospital services not under CNPS agreement

- Alternative or traditional medicine

Before treatment, always confirm with the hospital which services are covered by CNPS Health Insurance to avoid surprises.

How to Register or Check If You’re Registered

To use CNPS Health Insurance, you need to be registered and actively contributing. Here’s how to confirm:

- Visit your company’s HR office: They can tell you if you’re registered and share your CNPS number.

- Go to the nearest CNPS branch: Bring your ID and ask for your registration or contribution status.

- Use the CNPS online portal (if available): Some contributors can check their records online through the official CNPS Website

If you're unsure, it’s better to check before visiting the hospital. That way, you won’t be denied coverage when you need it most. Knowing your CNPS Health Insurance status helps you plan ahead for any medical expenses.

Step-by-Step: How to Use CNPS Health Insurance in a Hospital

Using CNPS Health Insurance in Cameroon is simple once you know what to do. Follow these steps whenever you go to a hospital:

Step 1: Choose an approved hospital

Make sure the hospital or clinic accepts CNPS. You can ask at reception or check with CNPS in advance.

Step 2: Present your CNPS card or number

Bring your CNPS card or provide your CNPS number and ID. Some hospitals may also request a CNPS form.

Step 3: The hospital fills the CNPS medical form

A hospital staff member or social service officer will complete the CNPS medical form with your information and the doctor’s findings.

Step 4: Pay the reduced bill

CNPS pays a percentage (usually 50%–80%) of the medical bill directly to the hospital. You’ll be asked to pay only the balance.

Example: Let’s say your total hospital bill is 20,000 FCFA. If CNPS covers 80%, you only pay 4,000 FCFA. This makes medical care more affordable for you and your family.

To avoid issues, always go with your documents and ask questions if anything is unclear. With a little preparation, using CNPS Health Insurance becomes stress-free and cost-saving.

How Much Will CNPS Pay?

The amount that CNPS Health Insurance pays depends on the type of medical service and the hospital. In most cases, CNPS will cover between 50% to 80% of your hospital or clinic bill. You are responsible for paying the rest directly to the facility.

For example, if your total bill is 15,000 FCFA and CNPS agrees to pay 80%, you will only pay 3,000 FCFA. However, the actual percentage may vary depending on the procedure, hospital category, or your employment status.

To avoid confusion, always ask the billing department how much CNPS Health Insurance will cover before treatment begins.

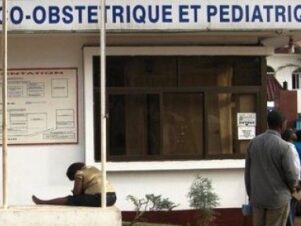

How to Find a Hospital That Accepts CNPS Health Insurance

Not all hospitals in Cameroon accept CNPS Health Insurance, so it's important to check before visiting.

Here’s how to find one:

- Most public hospitals accept CNPS, especially in big towns.

- Some private clinics are also accredited by CNPS. These are usually listed at CNPS offices.

- Ask the hospital staff directly or call in advance to confirm.

- You can also check with your HR department or the CNPS office for a list of approved facilities.

Tip: Always call ahead to confirm they accept CNPS Health Insurance, especially if it’s your first time visiting that hospital.

Also read about Top 10 Best Hospitals in Yaounde

Common Problems People Face (and Solutions)

Even though CNPS Health Insurance can be helpful, some users experience common issues. Here’s how to solve them:

- CNPS form not available? Ask the hospital's social service unit or collect one from a CNPS branch before your visit.

- Hospital refuses CNPS? This may be due to expired agreements or internal policy. Politely ask for a reason and try another approved facility.

- CNPS number not recognized? Visit the nearest CNPS office to update or correct your information.

- By staying informed and calm, you can fix most problems and still enjoy your coverage.

Tips to Get the Most from Your CNPS Health Insurance

To enjoy full benefits from your CNPS Health Insurance, follow these practical tips:

- Always carry your CNPS number or ID card.

- Use hospitals or clinics that are CNPS-accredited.

- Request receipts and keep copies of all your medical forms.

- Check your contribution status regularly at the CNPS office or online.

- Stay informed about updates in CNPS policies.

These small steps help protect your rights and ensure you get the best service when you need care.

Also read about Private vs Public Healthcare in Cameroon

Is CNPS Health Insurance Worth It?

If you're working and contributing to CNPS, the health insurance is a benefit you shouldn’t ignore. While it doesn’t cover everything, it can greatly reduce your out-of-pocket medical expenses, especially during emergencies or childbirth.

It’s also a helpful support system for families, retirees, and low-income earners who need affordable healthcare. The process may seem slow or bureaucratic at times, but it’s still better than paying full hospital fees.

If you're contributing to CNPS, don’t let it go to waste—use your CNPS Health Insurance when needed. Understanding the steps and knowing where to go can make a big difference for you and your loved ones.

Also read about The Ultimate Guide to L’hôpital Gyneco Yaounde

Frequently Asked Questions (FAQ)

Q1: Is CNPS Health Insurance free?

No. It is paid through monthly contributions by you or your employer. The services are subsidized, not entirely free.

Q2: Can I use CNPS at any hospital?

No. Only hospitals and clinics approved by CNPS accept the insurance. Always confirm before your visit.

Q3: What documents do I need?

You need your CNPS ID number, national ID card, and sometimes a CNPS medical form.

Q4: Does CNPS cover dental care?

Only basic or emergency dental procedures may be covered. Cosmetic dental services are usually excluded.

Q5: How can I register my children?

Visit a CNPS office with their birth certificates and your documents. Some conditions apply for dependent registration.